Contact Information:

Douglass Guernsey, Shareholder Advocate, dguernsey@greencentury.com, (617) 482-0800

Pam Podger, Communications Director, ppodger@greencentury.com, 802-299-9495

(Boston, November 13) Green Century° announced today that it has joined major investors in signing two letters urging action on the UN Global Plastics Treaty. The UN Global Plastics Treaty, due to be completed in 2024, would create a legally binding international agreement to cover the entire life cycle of plastics.

“UN member countries have a once in a lifetime opportunity to confront the plastics pollution crisis,” said Leslie Samuelrich, President of Green Century Funds. “We strongly support the highest level of ambition in the Global Plastic Treaty.”

Plastic pollution is seen as a worldwide crisis and market failure. Nearly 400 million tons of plastics are produced annually, primarily from fossil fuels, creating a carbon footprint of approximately 1.8 billion tons of emissions each year. Plastic is also known to have negative impacts on environmental and human health at every stage of its lifecycle.

The estimated annual greenhouse gas emissions from plastic production worldwide is more than the emissions from 400 million cars, or greater than of all the cars in North America combined.

The letter from the Dutch Association of Investors for Sustainable Development to the High Ambition Coalition, signed by Green Century and nearly 30 other institutional investors, urges countries to create a comprehensive, binding agreement to address global plastic design, production, and disposal. It also calls for investments in refillable bottle systems to replace single use plastics.

The second letter, CDP’s Open Letter to Governments, endorsed by 48 financial institutions with over $3.5 trillion AUM, calls for mandatory plastic data disclosure by all plastic producers globally.

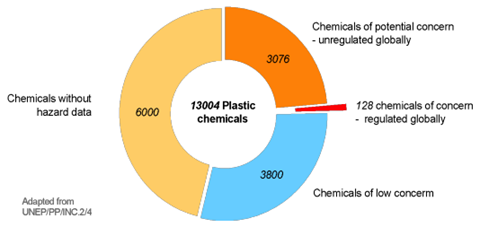

Progress has been made in recent years on plastic disclosure, yet many investors, corporations, and governments are still largely unaware of the types and quantities of plastics being produced. Requirements for better transparency are complicated by the more than 13,000 commonly used plastic additives which impact human health and decrease recyclability.

Of the over 13,000 chemical additives to plastic, over 70% have adverse impacts on human health or have not yet been the subject of scientific studies.

“The more you learn about plastics, the clearer the risks become,” said Douglass Guernsey, shareholder advocate at Green Century. “Plastic additives increase health and litigation risk for businesses and make plastic harder to recycle. After mandatory disclosure, the next steps are plastic reduction and commonsense solutions like refillable bottles.”

###

About Green Century Funds

°Green Century Capital Management, Inc. (Green Century) is the investment advisor to the Green Century Funds (The Funds). The Green Century Funds are one of the first families of fossil fuel-free, environmentally responsible mutual funds. Green Century hosts an award-winning and in-house shareholder advocacy program and is the only mutual fund company in the U.S. wholly owned by environmental and public health nonprofit organizations.

You should carefully consider the Fund’s investment objectives, risks, charges, and expenses before investing. To obtain a Prospectus that contains this and other information about the Funds please visit www.greencentury.com, email info@greencentury.com, or call 1-800-934-7336. Please read the Prospectus carefully before investing.

An investment strategy that incorporates environmental, social and governance criteria may result in lower or higher returns than an investment strategy that does not include such criteria.

Stocks will fluctuate in response to factors that may affect a single company, industry, sector, country, region or the market as a whole and may perform worse than the market. Foreign securities are subject to additional risks such as currency fluctuations, regional economic and political conditions, differences in accounting methods, and other unique risks compared to investing in securities of U.S. issuers. Bonds are subject to a variety of risks including interest rate, credit, and inflation risk.

This information has been prepared from sources believed reliable. The views expressed are as the date of this writing and are those of the Advisor to the Funds.

The Green Century Funds are distributed by UMB Distribution Services, LLC. 235 W Galena Street, Milwaukee, WI 53212. September/2023