Equity Fund for Individual Investors

The Green Century Equity Fund invests in one of the longest running sustainability indexes customized to be fossil fuel free, the MSCI KLD 400 ex Fossil Fuels Index. The Fund excludes environmentally harmful industries and includes companies that score higher on environmental, social and governance factors than their industry peers.

The composition of the MSCI KLD 400 ex Fossil Fuels Index is reviewed annually and rebalanced quarterly. Companies are evaluated to determine if they have maintained their Environmental, Social, and Governance performance and whether they remain part of the applicable MSCI universe.

Equity Fund Overview

Fund: $403.42 million

$100.38

+$0.04

2/13/2026

Green Century Capital Management°

Northern Trust Investments

Key Facts

Launch Date:

June 1991

Symbol:

GCEQX

CUSIP:

392768305

Minimum Investment/Fund

IRA Account: $1,000

Regular Account: $2,500

Sales Charge

None, No 12b-1

Expense Ratio:

1.20% (03/01/24)

The Green Century Equity Fund invests in one of the longest running sustainability indexes, the MSCI KLD 400 ex Fossil Fuels Index, which is customized to be fossil fuel free.

This passive equity fund allows individuals to invest their money in U.S. companies in an environmentally responsible way.

You can align your investments with your values and feel good about your choices by avoiding companies that harm the environment. You make a positive impact through our active ownership program that improves corporations’ sustainability practices. Finally, you support environmental educational and advocacy programs because 100% of our net profits belong to our non-profit owners.

The Green Century Equity Fund seeks to achieve long-term total return which matches the performance of an index comprised of the stocks of companies MSCI calculates to have high environmental, social and governance ratings. AKA, our equity fund allows you to invest as sustainably as you can by avoiding fossil fuels and following ESG criteria with the goal of a fair return over time.

The Green Century Equity Fund seeks to achieve its objective by investing in the stocks of the companies which make up the MSCI KLD 400 Social ex Fossil Fuels Index, a custom index calculated by MSCI, Inc.

Values-aligned exclusions:

- Coal, oil, and or gas companies (no exploration, extraction, processing, refining, or transmission)

- Tobacco

- Nuclear energy and nuclear weapons

- Firearms and military weapons

- Producers of GMOs (genetically modified organisms)

ESG criteria:

- The Green Century Equity Fund invests in companies MSCI calculates to have high Environmental, Social, and Governance (ESG) criteria.

A sustainable investment strategy that incorporates environmental, social, and governance criteria may result in lower or higher returns than a standard investment strategy that does not include such criteria.

Fund Performance

| Cumulative Returns as of 12/31/25 | Average Annual Total Returns as of 12/31/25 | |||||||||||

| Latest Quarter | Year to Date | One Year | Three Years | Five Years | Ten Years | Since Inception | ||||||

| Green Century Equity Fund Individual Investor Share Class (GCEQX) | 2.61% | 16.74% | 16.74% | 21.98% | 12.62% | 13.93% | 9.72% | |||||

| S&P 500® Index [1] | 2.66% | 17.88% | 17.88% | 23.01% | 14.42% | 14.82% | 10.80% | |||||

Performance is calculated after fees.

The total annual operating expense ratio of the Equity Fund Individual Investor Share Class is 1.20% respectively, as of the most recent prospectus.

The performance information provided on this website is past performance of the Equity Fund, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Equity Fund may be higher or lower than the performance quoted. To obtain performance current to the most recent month-end, please call 1-800-93-GREEN. Performance includes the reinvestment of income dividends and capital gains distributions. Performance shown does not reflect the deduction of taxes that a shareholder might pay on Fund distributions or the redemption of Fund shares. A redemption fee of 2.00% may be imposed on redemptions or exchanges of shares you have owned for 60 days or less. Please see the prospectus for more information.

Portfolio Characteristics

As of 12/31/25: (51.55% of net assets)

| NVIDIA Corp | 15.82% |

| Microsoft Corp | 11.83% |

| Alphabet, Inc., Class A | 6.34% |

| Alphabet, Inc., Class C | 5.39% |

| Tesla, Inc. | 4.47% |

| Visa, Inc., Class A | 2.11% |

| Mastercard, Inc., Class A | 1.73% |

| AbbVie, Inc. | 1.42% |

| Advanced Micro Devices, Inc. | 1.23% |

| Home Depot, Inc. | 1.21% |

View the complete holdings of the Green Century Fund.

As of 12/31/25:

Asset Allocation

As of 12/31/25:

Common Stocks: 100.76%

Cash and Equivalents: -0.76%

Individual Investor Net Asset Value per Share: $101.40

Portfolio Managers for Investors

Investment Advisor: Green Century Capital Management

Green Century Funds provides investment advisory services to the Equity Fund, including overseeing Northern Trust’s daily portfolio management. Green Century Funds also coordinates the Equity Fund’s operations and compliance functions, as well as shareholder advocacy efforts.

Investment Sub-advisor and Portfolio Manager: Northern Trust Investments

Northern Trust Investments is the sub-advisor to the Green Century Equity Fund, providing day-to-day portfolio management of the Equity Fund. The firm has managed socially responsible investment portfolios for more than 30 years and is a leading provider of investment management, asset and fund administration, banking solutions and fiduciary services for affluent individuals worldwide. Northern Trust, a financial holding company based in Chicago, Illinois, has offices across 19 U.S. states and 20 international locations in North America, Europe, the Middle East, and the Asia-Pacific region. For over 130 years, Northern Trust has earned distinction as an industry leader in combining exceptional service and expertise with innovative investment products and technology.

Equity Fund Provider: MSCI ESG Research

MSCI ESG Research measures and models environmental, social and governance (ESG) risk to provide critical insights that can help institutional investors understand how ESG can impact the long-term risk and return profile of their investments. Their pioneering ESG Research team provides in-depth research, ratings and analysis of the ESG business practices of thousands of companies worldwide, which are used to develop their ESG indexes.

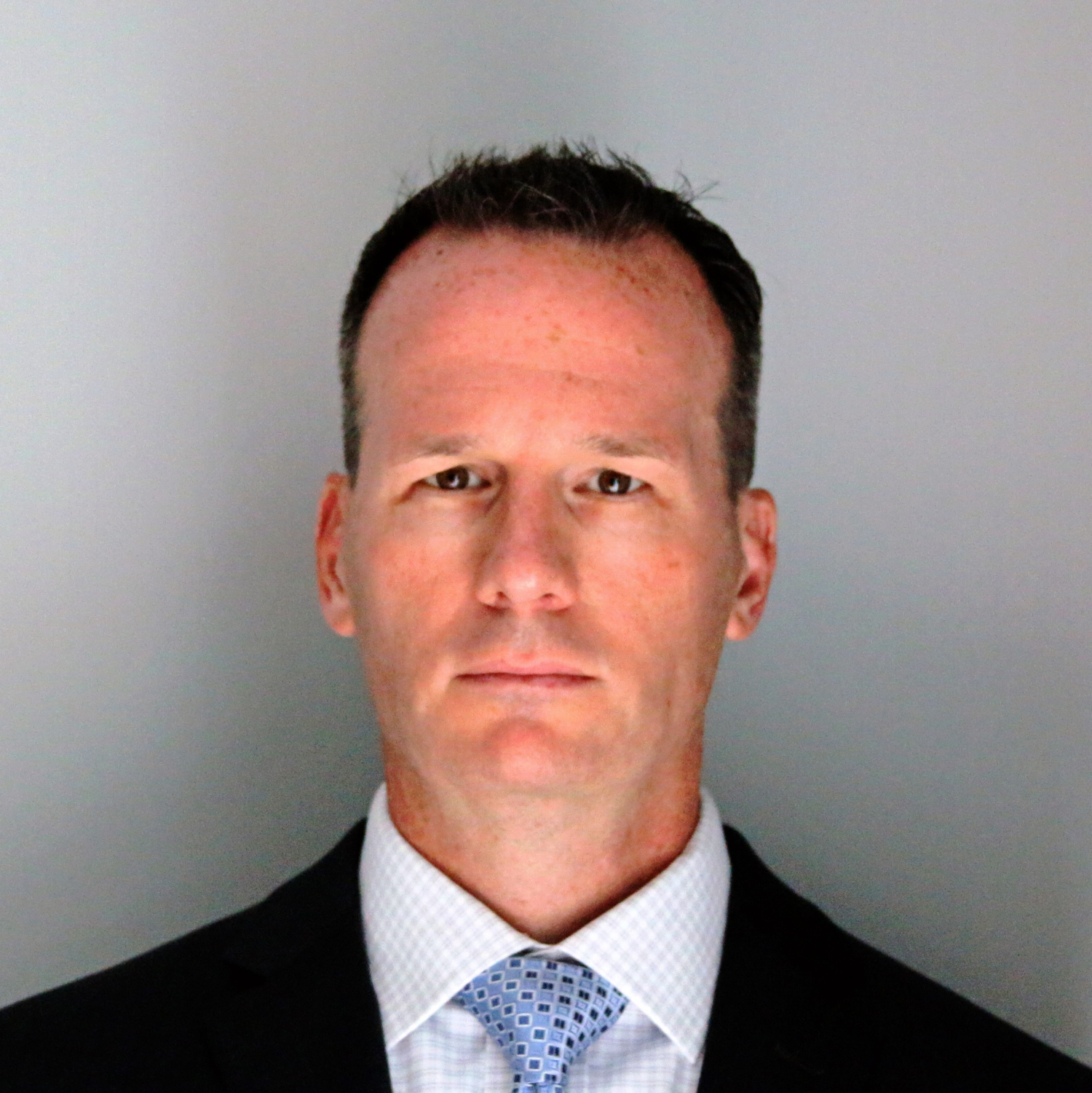

Vice President

Northern Trust Global Investments Business Unit

Keith started his career at Dow Jones in 1995, where he helped create the Dow Jones Indexes business. He was the head of Index Development from 1999 to 2006. He began working as an index analyst and trader for Wachovia’s program trading desk in 2006. Keith joined the domestic portfolio management team at Northern Trust in 2007.

Keith Carroll is the Portfolio Manager for the Equity Fund.

Keith received his Bachelor of Science in Finance from The College of New Jersey